What GST can do for you? Explained..

With the Government giving green signal to the four supplementary GST bills on March 29, 2017, the mayhem around GST has hiked both in common people and the business class. You may find people talking about filling up your inventories with common supplies claiming that the prices would rise after 1st of July. Another chunk of mass is going all out to speak in favor of GST bills, leaving you nipping your hair in confusion, torn between the supporters and the challengers.

Stop fretting, for its time to sit back and do your homework on GST. We are here to let those creases on your forehead to iron out and help you in preparing an action plan for the upcoming month. So buckle up! Prepare your notebook and start taking notes.

What Does A Layman Need to Understand About GST?

Okay, we have enough technical and economical terms roaming about on the internet today. So we have made every effort in this article to steer clear of all of the confusing stuff and fit into your head, the very basic implications of GST bill.

So starting off, Let us discuss the need of GST altogether. Let’s take an example- Mr. Patnayak is a thriving businessman and he wants to start a business. He needs raw materials that need to be imported from China to Kanpur- via various road and rail routes. Everything is okay until he gets down to the process of cost estimation. He discovers that he needs to pay a troublesome hoard of taxes besides custom duty for importing material and for transporting in through the states. In his study, he finds out, that sometimes even a TAX IS TAXED BY GOVERNMENT. Sounds baffling, right? It is this very effect of cascading taxes that a liter of petrol that marketing companies sell out initially at Rs 25.46 is sold at Rs. 62.51 in Delhi.

This is the very reason why GST has been introduced in the picture- to streamline those zillions of direct and indirect taxation regimes and to unite our nation through a uniform tax rate. It is notable that we still have dual taxation- central GST or CGST and state GST or SGST.

GST will curb all the indirect taxes being levied currently in the nation and instead of a fluctuating, state varying rate list, the interest rates will be pegged at a peak of 20 percent. The taxes that will be subsumed by GST include sales tax, CENVAT, OCTROI, excise duty, service tax, entertainment tax etc.

Source- India Today

So by and large, GST or Goods and Service Tax , will simply create an economic environment akin to a common marketplace where irrespective of the origin of the product, all the goods will have common treatment and common capped rate. That is all you need to know about the technical aspect of GST to be able to function optimally within a GST enabled economy.

So how will all this help common man in India? Three things-

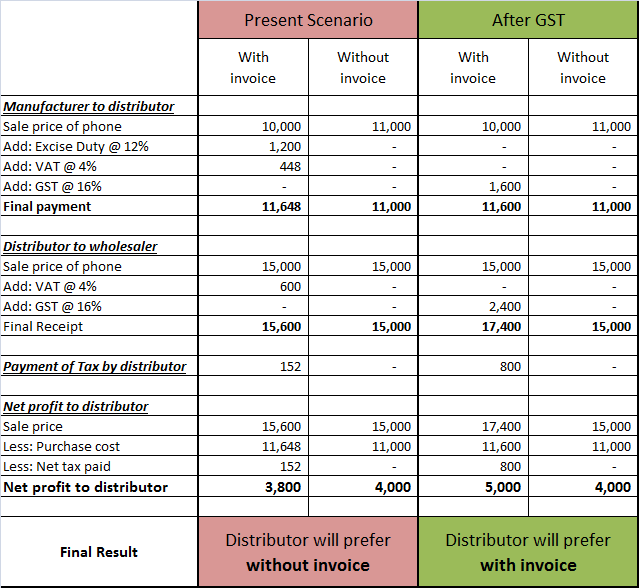

- Reduction in tax evasion- Plausibly, any trader would no longer make refusals in taking receipts and bills for their purchases. It’s simple math. This is because they will gain better profit margins this way. You can see for yourself here-

Source- Quora

- Reduction in tax evasion- Plausibly, any trader would no longer make refusals in taking receipts and bills for their purchases. It’s simple math. This is because they will gain better profit margins this way. You can see for yourself here-

- More money can be Channeled to underdeveloped states- This is because the framework of GST deems it favorable toward states that consume more, rather than who produce more. Currently, the taxes are concentrated in the states which produce, and not consumed. Typically, goods are consumed more in states with a higher population, accruing taxes to the states which need more money.

Source- Quora

- More money can be Channeled to underdeveloped states- This is because the framework of GST deems it favorable toward states that consume more, rather than who produce more. Currently, the taxes are concentrated in the states which produce, and not consumed. Typically, goods are consumed more in states with a higher population, accruing taxes to the states which need more money.

- Support to smaller businesses- Because GST strives to remove location based bias, small businesses, who were earlier caught up in the process of chalking out geographical and location-based strategies would now be able to focus on their work since the disparity between state taxes will be gone.

GST and the companies that “Produce”

Manufacturing companies form the backbone of an economy but our companies have been in a sluggish state since too long. Right now, many producing companies are in a gibberish state, unable to decide whether they should stock up their inventory or reduce it. Before we answer this, let us look at following points-

- Reduction in overall cascading taxes- GST will allow producers to set off some taxes in production value chain. This will immensely curb the cascading taxes that sellers and resellers have to face and will most probably bring down the prices of finished products.

- The overall costs of Logistics to be reduced- Obviously, given that all the umpteen numbers of taxes would be eliminated, it will be much easier to shift goods and final products within the states in the country.

- Dissolution of MRP- the valuation rules of the product after GST implementation will directly depend on open market value, so the concept of MRP will be dissolved.

- No loss under GST due to rise of existing rates- There are some provisions in SGST act where the final product is exempted from Vat whereas the input credit is liable for VAT paid. This means companies with larger inventories will be eligible for credit which will give them an edge over companies with smaller inventories. The final product is bound to be cheaper as well.

- Cheaper production- all of the factors described above will lead to a cheaper production rate.

- Hassle free Goods supply- The 40% time and money that went down the drains in transporting goods through states will cease possibly with GST working in their favor.

So considering these factors, what should the “Producers” do? Should they stock up? Should they let their stocks dwindle down? The answer is- It depends. Stock and assets back up remain an amalgamation of various factors including obsolesce cost, storage cost, finance cost etc. Sure, GST will delete multiple taxes levied by various organizations but looking at this issue from a single perspective will do no good.

How Will GST manifest itself for Consumers?

Well, currently, until we have final rates of entire things post- GST launch, GST will remain as a box of chocolate for the consumers. You will never know what you’ll find next. But yes, we can describe some general trends that will be followed after the pan India GST implication.

- Quick grubs to get costlier- Well, sorry to break this news to you but things like eating out frequently is likely to burn a larger hole in your pocket in near future. Currently, your food at any popular restaurant is charged with an average of 18 percent tax which includes both service tax and VAT. Under GST apparatus, the rates have been speculated to be fixed at 18 percent at least and most likely, the states would probably hike these rates in their favor. So bid adieu to your late night pizza parties and chicken bites.

- Falling outs with phone bills- We know how much you await those all-nighters where you can have a full night chat with your lover, but you need to either cut down on your calls or the calls would come cutting down your pocket after GST application is accomplished. Rajan Mathews, Cellular Operators Association of India has made it crystal clear that that calls and internet pack rates are bound to hike because of change in taxation.

- Time to Go on a Shopping Spree- Time to don some brand new garbs as the textile and readymade garments will be cheaper as an aftereffect of GST.

- Best Time To Buy a New Car- GST will slash down car rates considerably. Ruling out the 12.5% excise duty that cars used to attract in the past besides VAT and other taxes, A car worth 5 Lakhs which had the final market cost of Rs. 6.25 Lakhs, can be available at approximately Rs 5.9 Lakhs after GST implementation.

- Phone turning expensive- Time to sympathize with those tech gizmos who can hardly bear sharing their lives with a single phone for more than 2 months because the price rise in the cost of mobile phones will send their budget and financial security hurtling right down into death. Sad.

How Will GST Effect Freelancers?

Freelancing in India is currently bound by no set rule and pattern but with the advent of GST, freelancers with taxable income will need to get registered under GST and pay tax on the services provided. Have a look at the impact of GST on freelancers-

- No cascading taxation- Up until now, the freelancers, who provided any online service such as designing software, would need to pay both service tax as well as VAT. This created a cascading effect of tax here as well, so this would be removed with the introduction of GST.

- Exemption capping increased- Before GST, the exemption was provided for a turnover of Rs. 10 Lakhs under present service tax law, now that capping will be increased and people would be liable for exemption if they have an annual turnover of Rs. 20 Lakhs.

- Increased tax rate- Currently, freelancers need to pay 15% service tax with will be hiked by 3% to become 18% by GST law.

- Multiple GST registrations- For the freelancers, who provide services for different states, will have to get registered themselves under multiple state GSTs because of there no centralization of the registration currently. This will also increase the burden of compliance because there will be multiple returns filed from different locations every year.

Is GST a Boon For Your Startup?

GST has created mixed emotions in the startup business regime. People fear that the taxes would be increased as many startups rely on freelancing as well to create some form of revenue, but overall GST is deemed to benefit the startup industry as a whole. The reasons are-

- Ease of starting the business- You no longer have to decide the name of the state based on taxation regime, to pull off the registration of your startup. There will be uniform tax rates, so you can now focus on providing better services rather than worrying about the location of your business.

- Profit from higher exemption- Currently, any business with a turnover of INR 5 Lakhs as eligible to pay Service tax and VAT. This limit is to be increased up tp INR 10 Lakhs under GST.

- Reduction in logistic cost and management- with all the cascading taxes out of the picture; it will be much easier to maintain the logistics, with the cost cutting down on the maintenance and transport as well. A CRISIL analysis shows that logistic cost of producing non-bulk goods can be slashed by as much as 20%.

Things to do Before GST framework is applied-

- Producers need to think about restructuring their supply chains and include changes in warehouse functioning so as to increase their profit.

- Manufacturing companies need to immediately do a self-valuation and analysis of their supplies and inventories so that they can calculate whether to stock up or loosen down on their inventories.

- Company secretaries and cost account experts need to dig deeper into the concept of compliance so that they can correctly evaluate manufacturer data.

- Consumers can sit back and wait for some amazing pre- GST sales. Dabur has already announced one recently. Let’s see who’s next in the queue.

- As a common person, you need to register afresh for GST if you are currently paying any kind of VAT or service tax.

- If you are a company, then you need to update your ERP module to match the new billing system.

- Once you do the preliminary migration to GST, you will need to do monthly compliance with GST. It is a humongous exercise, to begin with, but having right weapons in your arsenal will help you go long way. You can seek assistance from the various GST Suvidha Providers as well.

Leave a Reply

Want to join the discussion?Feel free to contribute!